Can UAE Companies Recover WHT from Saudi Arabia—Even If They Pay 0% Corporate Tax?

As trade and cross-border services between the UAE and Saudi Arabia grow rapidly, many UAE-based service providers are encountering an unexpected deduction on their invoices: Withholding Tax (WHT) by their Saudi clients.

This situation often leads to a pressing question:

“If our company pays 0% corporate tax in the UAE, can we still recover the WHT deducted in Saudi Arabia?”

The answer is yes. And here’s what you need to know.

What Is Withholding Tax and Why Is It Deducted?

Under Saudi Arabia’s tax regulations, any payment made by a Saudi-based company to a non- resident entity—even if the service is performed remotely—is subject to WHT, deducted at the source.

Common WHT Rates in Saudi Arabia:

- 5% – Technical or consulting services

- 15% – Services provided by related parties

- 20% – Management fees

- 15% – Royalties and IP-related payments

These deductions can significantly impact your profit margins—especially for startups and SMEs operating from the UAE, which historically had no corporate tax until recently.

The UAE–KSA Double Taxation Agreement (DTA): Your Path to Relief

Thanks to the Double Taxation Avoidance Agreement (DTAA) between the UAE and Saudi Arabia, businesses have two primary ways to reduce or recover WHT:

1. Benefit at Source – Apply in advance to avoid WHT deductions entirely

2. Refund Mechanism – Claim a refund of WHT already deducted through ZATCA (theSaudi Tax Authority)

This post focuses on the refund process, especially relevant for UAE companies that either fall under the 0% UAE corporate tax threshold or qualify for Small Business Relief (SBR).

Can You Claim a Refund If You Pay 0% Tax in the UAE?

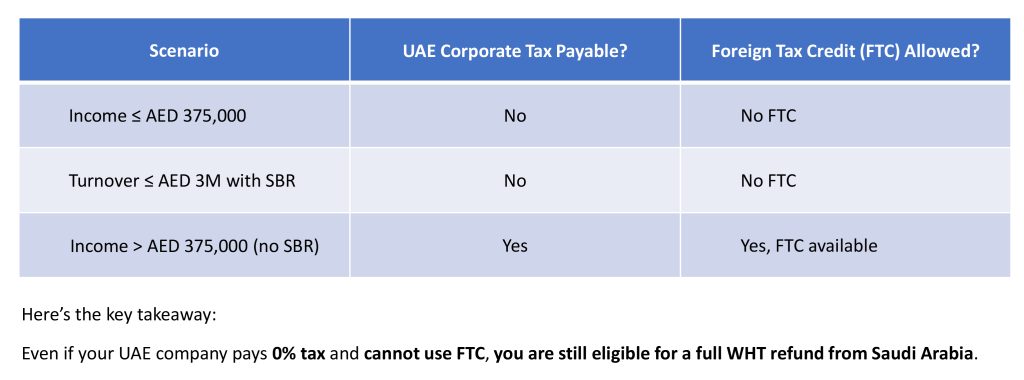

Let’s break this down with current UAE Corporate Tax rules:

Scenario UAE Corporate Tax Payable? Foreign Tax Credit (FTC) Allowed?

How to Apply for a WHT Refund from Saudi Arabia

If WHT has already been deducted by your KSA client, here’s how to claim it back:

Required Documents:

- UAE Tax Residency Certificate (TRC) – attested by the Saudi Embassy

- Form Q/7B – completed by the UAE company

- Form Q/7C – completed by the Saudi client

- Copy of WHT return and payment receipt from the client

- Authorization letter for the client to receive the refund (attested)

- Attested letter from the client stating that the refund has not been claimed elsewhere

Submission Process:

1. The Saudi client submits all documents via the ZATCA online portal

2. ZATCA reviews the application, and may conduct an audit

3. If approved, the refund is paid to the client’s bank account, who then transfers it to the UAE company

Deadline:

Refund claims must be submitted within 5 years of the WHT payment date.

Tips for UAE Businesses Working with Saudi Clients

- Yes, you can recover WHT even if you’re taxed at 0% in the UAE

- Maintain strong coordination with your Saudi client—they must file the claim

- Keep thorough documentation: service agreements, TRC, WHT receipts, invoices

- For future contracts, consider applying for Benefit at Source to bypass WHT altogether

Final Thoughts: Don’t Leave Money on the Table

Withholding Tax doesn’t have to eat into your profits. UAE companies—regardless of their local tax liability—can fully recover WHT from Saudi Arabia by following the proper procedures under the Double Taxation Agreement.

Whether you’re a consultant, marketing firm, tech provider, or freelancer, don’t overlook this opportunity to reclaim what you’ve earned.

Need Help with WHT Refunds or Cross-Border Tax Planning?

GSPU Tax consultancy can guide you through the refund process and ensure full compliance across borders. Let us help you maximize your profitability and avoid tax surprises.

Contact us today for expert assistance.