Internal Audit

Internal Audit Firm in Dubai, UAE

Internal analysis ensures that the organization is working fairly enough to mitigate risks and that business goals and objectives are met. To do this, an internal audit firm in Dubai works with an organization to systematically review its systems and business operations. These reviews are focused on recognizing how well risks are managed and whether agreed-upon procedures are being followed.

What is Internal Audit?

Internal auditing can be defined as a process in which a company’s complete & thorough examination and analysis can be done. The internal audit firm in Dubai is done to understand the present condition of the company and also to ensure that all the compliance protocols of the jurisdiction are being followed by the company.

Internal analysis is one of the two different types of Audit which can be done by a business. This type of Audit is usually performed by organisations that have good financial backing. Such an organisation can also develop and sustain its own audit department. This will allow the management to have a quick audit as per the need and requirements of the company.

1. Increases the Operational Efficiency

Internal audit reviews your organization’s policies and procedures periodically. These processes help in mitigating your business risk. The continuous monitoring and review will allow you to identify recommendations to improve the effectiveness of the business processes.

2. Evaluates Risks and Protects Assets

An internal audit program assists management and stakeholders in identifying risks through a systematic risk assessment. A risk assessment can help to recognize any gaps in the business environment and helps to overcome the same.

3. Effective Control

Internal audit improves the efficiency of the organization by controlling its business risks. Periodic auditing allows the management to identify the suitable solutions to the predominant business risks.

4. Ensures Compliance with Corporate Laws and Regulations

Internal audit helps you prepare your company for an external audit. It will be easier to prepare the legal documents with the help of periodic internal audits.

-

-

- Internal auditing helps a business assess its effectiveness and efficiency, and thus serves as a measure of performance analysis.

- It can prove as a proactive tool for risk management by proactively detecting any anomalies or inconsistencies in a company’s operations or reporting.

- Internal auditing helps a business revisit its key business processes, providing the opportunity to scale and improve persistently.

-

The management of the business which is conducting the internal Audit should be clear of its objectives and the results achieved after the Audit. The objectives of Internal Audit are:

- Measuring and Analysing regulatory Compliance

- Keeping a close eye on the internal controls of the business

- Predicting Business risks.

- Developing Future Business plans

- Asset Protection

Internal auditing refers to an independent, objective assurance and consulting activity designed to add value and improve a company’s operations. It helps the company accomplish its objectives by bringing a systematic, disciplined approach to evaluate and improve the effectiveness of risk management, control and governance processes.

Internal auditing is a profession designed to improve an organization’s operations. Performed by certified internal auditors with in-depth knowledge of the business milieu, systems, and process, it helps an organization to meet its predetermined objectives and goals in a systematic approach to study and improve the effectiveness of risk management, control and governance process.

Internal auditing ensures that the organization is working fairly enough to mitigate risks, and that business goals and objectives are met. To do this, internal auditors work with an organization to systematically review its systems and business operations. These reviews are focused on recognizing how well risks are managed and whether agreed procedures are being followed.

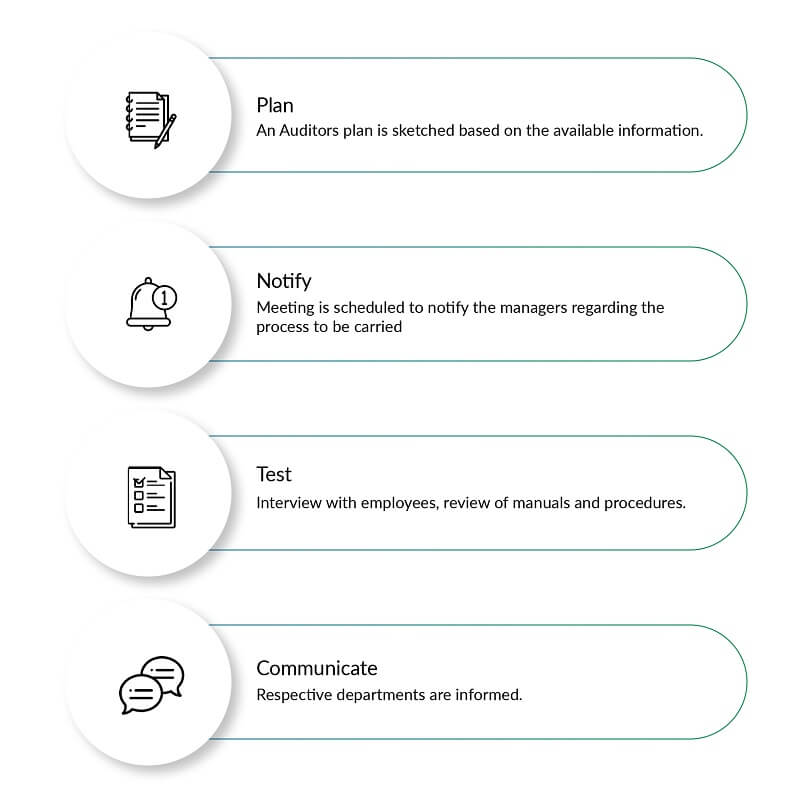

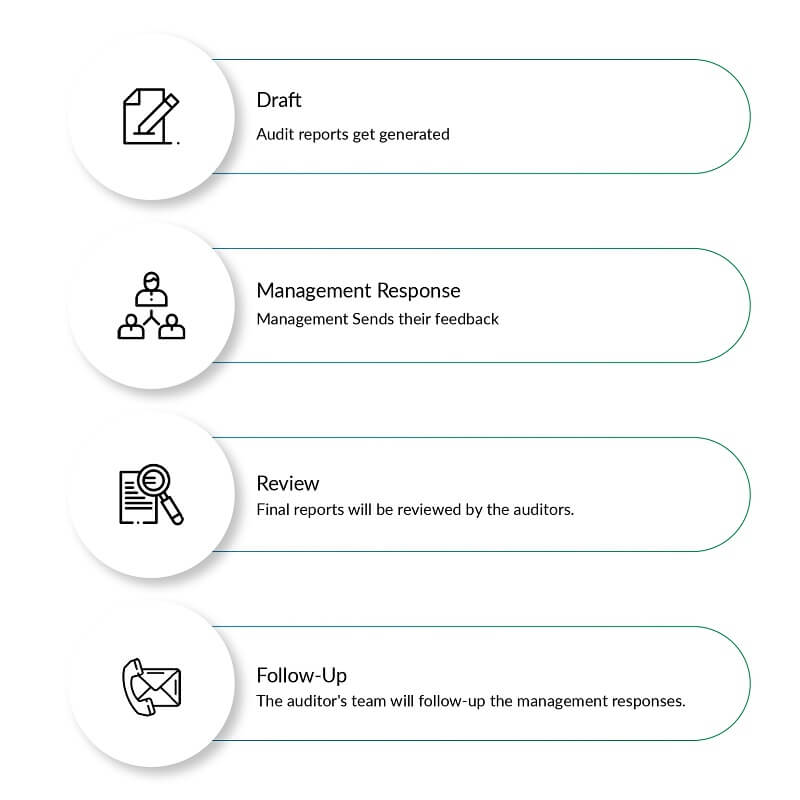

Although the audit specifications change according to the organization, the audit process is similar for most organizations and consists of nine stages. Audit firms in Dubai conduct the following procedures to minimize the business risks and increase the efficiency within an organization:

An internal auditor will be able to avail all the relevant documents and analyse the company’s growth. The audit will help a company to catch hold of any discrepancy in the business working and will also suggest a remedy to any such problem so that there is no further problem in the future.

The reasons due to which Internal Audit is essential for a business are:

- It helps to maintain all the compliance requirements of the jurisdiction.

- It helps to evaluate any present or future risk and to plan future business.

- It will allow the businesses to stay on course and will alert the management of any deviation.

- It is one of the most crucial functions as it will allow the management to take decisions as to how should they manage the business processes.

Different types of company audit are available to a business. The management should be careful in selecting the type of audit which will be suitable for the company. The two types of audits which are the most frequently used by a company are Internal Audit and External Audit.

Both of these are audits that will tell the management about the different matrices about the company and will help in deciding a future path for the business, but the results giving by both of them are different.

In an Internal Audit, the company audit will be conducted by a dedicated department of an individual who is already on the payroll of the company. This type of audit will provide great detail to the management about the internal workings of the company as it will be conducted by a person who is already part of the company and is familiar with the workings and processes of the company.

However, the chances of fraud being committed in such a case are greater as there will be no one else to oversee the audit. The management can conduct an external audit after conducting an internal audit as it will provide greater details about the company and will also examine the information generated during the internal audit of the company.

One question which bugs people in business is that when should they conduct an audit of their company? There are many different scenarios in which the management should look forward to conduct the company’s Audit which are:

- If your actual company data of the business is very different from the estimation.

- There is a downfall in the cash flow of the business.

- Before making any investment.

- When there is an increase in the employee turnover ratio.

- Periodically or as decided.

In these five (5) scenarios, the company’s management should conduct an audit of the company. The company management should understand the business requirements and accordingly decide on the type of Audit required for the company. This is why it is suggested that the management should take the assistance of a reputed firm which will take care of all the auditing requirements of the company.

Our Auditing firm in Dubai and the rest of the UAE provides the following internal auditing services:

- Evaluating business risks and offering relative suggestions

- Compliance auditing, informing the management of the degree of compliance with established policies, procedures, laws, regulations, contractual provisions, etc.

- Examining the company operations to assess the company’s performance with respect to its business objectives

- Advising and assisting the organization in the development of internal audit and risk methodologies

- Assisting the management in detecting the presence and extent of financial inconsistencies, if any, and in gathering any necessary evidence for legal purposes

- Assessing a company’s internal control structures, ensuring compliance with the regional laws and regulations, and confirming adherence to operational procedures

- Identifying areas of ancillary revenue and gaps in the current revenue streams

- Providing practical recommendations for improvement in control systems

At GSPU, we offer interim and full-time internal audit. Our internal audit professionals take a risk-based approach to internal audit to help clients improve performance and operating efficiency. We go beyond traditional fundamentals and add tangible value, to elevate internal audit to an even more strategic and productive role in today’s corporate governance environment.

We provide an independent professional evaluation and advise on the quality and effectiveness of the control environment within the organization. We also identify areas for improvement and implement strategies to help you to achieve your organizational objectives and make a positive contribution to the successful operation of your business.

Related Services

Looking for a Professional to carry out your Auditing tasks?

Drop us a line and keep in touch