Excise Tax Service

Excise Tax UAE

Globalization has opened gates for businesses to carry their business activities at an international level, across national boundaries. The business transactions result in the import and export of goods and services during the process. Now, several types of taxes are levied on these goods. One of the such types is the excise tax. It is a tax levied on the import of certain goods that are harmful to human health. In order to deal with these goods, an excise tax in UAE registration needs to be done as per the law. The GCC countries are expected to accept the framework with different rates for a different range of products so that the business activities will be conducted on a legal basis. The specific goods include Tobacco Products, carbonated soft drinks, and special-purpose goods that are believed to have adverse effects on human health.

Main Features of Excise Tax

Excise tax is ultimately borne by the final consumers but is collected at an earlier stage in the chain. The main features of excise tax are:

-

-

- It is mainly levied on consumption goods

- It is applied to special goods

- It is levied either during the production stage or at the import stage

- It is collected by businesses on the behalf of the tax authority

-

The Federal Tax Authority (FTA) has brought the excise duty into existence since Oct 2017. Businesses registration for excise tax takes through the e-service section available on the FTA website. For the excise tax registration service, UAE demands the submission of certain essential documents that are mandated to achieve the taxation number.

The excise tax rates in UAE are as follows:

Carbonated Drinks | 50% |

Tobacco Products | 100% |

Energy Drinks | 100% |

Since excise duty relates to the special goods, businesses dealing with these goods should undergo the excise tax registration process that includes producers, importers, stockpilers, and warehouse keepers of excise goods.

Excise tax can be charged via any of the following methods:

1. Specific Excise Tax

Here, the tax is charged by quantity, irrespective of price or weight.

2. Ad-Valorem Excise TaxHere, the tax is charged considering a specific percentage on the value of the product.

The documents required for excise tax registration are:

- Trade license

- Business activity-related information

- Declaration

- Certificate of Incorporation

- Articles of Association

- Custom number issued by the custom department

- Passport of manager, owner, and senior management

- Authorized signatory documents

- Bank account details

- Emirates ID

- Partnership agreement

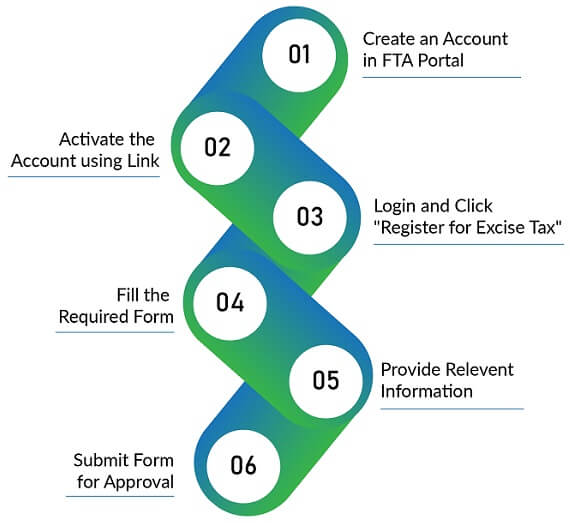

Registration for excise tax is a mandated process to continue any business dealing with excise goods. The FTA provides the flexibility of registration for the excise duty using an online portal. The procedure of registration for excise tax online includes the following steps:

The stages that an excise tax registration may go through are as follows:

GSPU is a Dubai based company that helps businesses to deal with accounting, taxation, audit processes. Since its inception has been dealing with multiple clients throughout the world and has been a helping hand in establishing their businesses. We have got business experts who would help you in gaining your excise tax certificate to initiate your business regarding excise goods. To start your business journey, do contact us. We would be happy to assist you in the process.

The business activities under excise tax registration include import, export, manufacturing, trading, storing, and transportation of excise goods.

Any business registered under excise tax should file the excise tax return on a monthly basis and within 15 days the filing fee needs to be cleared.

When a business needs to undergo the process of excise tax payment, initially it needs to get registered with the Federal Tax Authority (FTA) and submit the excise tax return on a monthly basis. Once submitted, payment of the excise tax on the same date needs to be done.

Related Services