External Audit

External Audit Service in Dubai, UAE

Audit simply refers to examine and give comments on the items verified. Financial audit implies an examination of the books of accounts and other relevant records. This will provide the auditor necessary information to give his opinion whether the accounts are properly maintained and complied with necessary statutory, accounting or financial reporting and auditing standards.

GSPU Auditing is a leading Audit & Accounting Firm in Dubai, UAE Providing the best External Audit / Financial Audit Services in Dubai, UAE.

A financial statement audit is an independent appraisal of the financial statements prepared by the organization. The basic objective of a financial statement audit is to provide an independent or third-party assurance that the management has, in its financial statements, presenting a “true and fair” view of a company’s financial performance.

The result of this examination is a report by the auditor, attesting to the fairness of presentation of the financial statements and related disclosures. The auditor’s report must accompany the financial statements when they are issued to the intended recipients or stakeholders.

An external audit can be understood as a process in which all the financial books of a company are examined. This type of Audit is usually conducted by court order and is conducted by a third party that has no relation to the company being audited. Similar to an Internal Audit, an External Audit will also provide detailed information about the company, which will be helpful to both the management as well as the investors and shareholders.

An external audit is considered more impartial and without bias, as the Audit is conducted by a third party. The management has to appoint a separate auditor or auditing team to conduct the External Audit of the company. Because of these reasons conducting an External Audit of a company is very important.

Apart from being unbiased, there are many advantages of conducting an external audit for a business like:

-

-

- A Complete and Comprehensive business report.

- Ensures that all the compliance requirements of the jurisdiction are followed.

- As it is conducted by a third party, it will also provide a different perspective of how to manage the business.

- Assists the management in the judicious and proper utilization of resources, thus curbing wastage.

- Increases the confidence of the investors and will bring in more investors.

- Helps to understand the workings of the business and will prepare it for the future.

-

There are many different reasons because of which a company requires External Audit. Some of the benefits of External Audit to a business is as follows:

-

-

- An External Audit provides an outlook about the business from an external point of view which can help the management to understand the business as well as the business environment.

- It provides a benchmark to the businesses and also assists the management in planning for the future.

- There are many compliance requirements that need to be fulfilled by a business, and an external audit helps in ensuring compliance.

- An external Audit helps in increasing the credibility of the business and also helps in attracting more and more investors.

-

There are two different types of Audits available to a business, namely Internal Audit and External Audit. These audits provide similar end results but are different from each other.

-

-

- An External Audit is usually performed by an individual or a team of individual who is not related to the organization, whereas the internal Audit is conducted by an individual or team of people who are under the payroll of the organization.

- An External Audit is usually performed to examine if the information revealed by the management is correct and can be trusted, whereas an internal audit is conducted by the management to understand the business activities and if anything can be made better.

- An external audit can be conducted after a business quarter or a financial year is over or when there is a huge change in the organization, either financial or structural. An internal audit can be conducted as per the need and requirement of the business as it is conducted by a specific department of the organization.

-

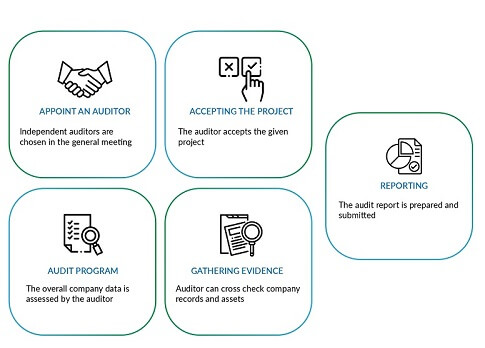

Before embarking on a journey to conduct an External Audit for your company, there are some points which should be kept in mind of the management. Some of the important points to keep in mind are:

-

-

- First and foremost, the management should understand the basics of how an External Audit works and what are the results that can be obtained by it.

- After understanding how the external Audit works, the management should obtain all the documents which will be required in the process.

- In certain scenarios, it is not possible for the management to conduct an internal audit themselves. In such circumstances, the management needs to hire an expert who will understand the requirements of the business and will provide a solution accordingly.

-

This is why it is suggested that the management should take the assistance of a reputed firm which will take care of all the auditing requirements of the company.

A well-planned verification is necessary to cover all financial items with audit materiality. An audit involves the collection and evaluation of evidence in support of conclusions arrived. The procedures which will assist the auditor in this direction are:

- Planning and risk assessment: Involves gaining and understanding of the business and the business environment in which it operates, and using this information to assess whether there may be risks that could impact the financial statements.

- Internal controls testing: Involves the assessment of the effectiveness of an entity’s suite of controls, concentrating on such areas for proper authorization, safeguarding of assets and the segregation of duties.

- Substantive procedures: Involves a broad array of procedures, of a small sampling.

An audit provides a high level of assurance. But a review engagement gives a reasonably lesser degree of assurance than an audit. As in a review, the auditor does not carry out all those procedures that are carried out in an audit. Publicly held entities must have their quarterly financial statements reviewed, in addition to the annual audit.

Sometimes the requirement is only to report on individual items of financial data or on a set of financial statements to report on the factual findings, say to certify only the turnover of the company. The level of assurance in such agreed-upon procedures is again lower than a review engagement.

In the case of a compilation engagement, the auditor is called upon to prepare the financial statements – where his expertise in collecting, classifying and summarizing the financial information are only demanded and not designed to give any assurance on the financial statements.

-

-

- Revenue

- Procurement of Goods/ Services

- Inventory

- Logistics

- Information Technology Infrastructure.

- Finance

- Fixed Assets

- Statutory Compliance

- Admin & general Operations, etc.

-

As it will be a continuous process, the scope does not end with the submission of reports. The follow-up action taken report (ATR) will be presented to the management on the status of observations and its closure status. Any long-pending observations critical to the business will be bought to the notice of the management to set a further course of actions.

Independent review and appraisal of the organization’s financial and relevant operational activities will be better when the auditor is not part of the organization and is independent.

GSPU is an Audit Firm offering a wide range of business services, including accounting, auditing, software consultancy and management. We have been providing the best audit services in Dubai and other areas as well. At GSPU, we follow precise and proven approach to ensure that every item requiring investigation and verification of financial records are properly substantiated. Out External Audit Covers:

-

-

- Analysis of business performance against predetermined management objectives.

- Examining the accounting records and checking other evidence supporting financial statements.

- Assessment of business risks and providing the relative suggestions.

- Follow-up & action taken Reports.

-

Looking for a Professional to carry out your Auditing tasks?

Drop us a line and keep in touch